08 October 2025 | Wednesday | News

Picture Courtesy | Public Domain

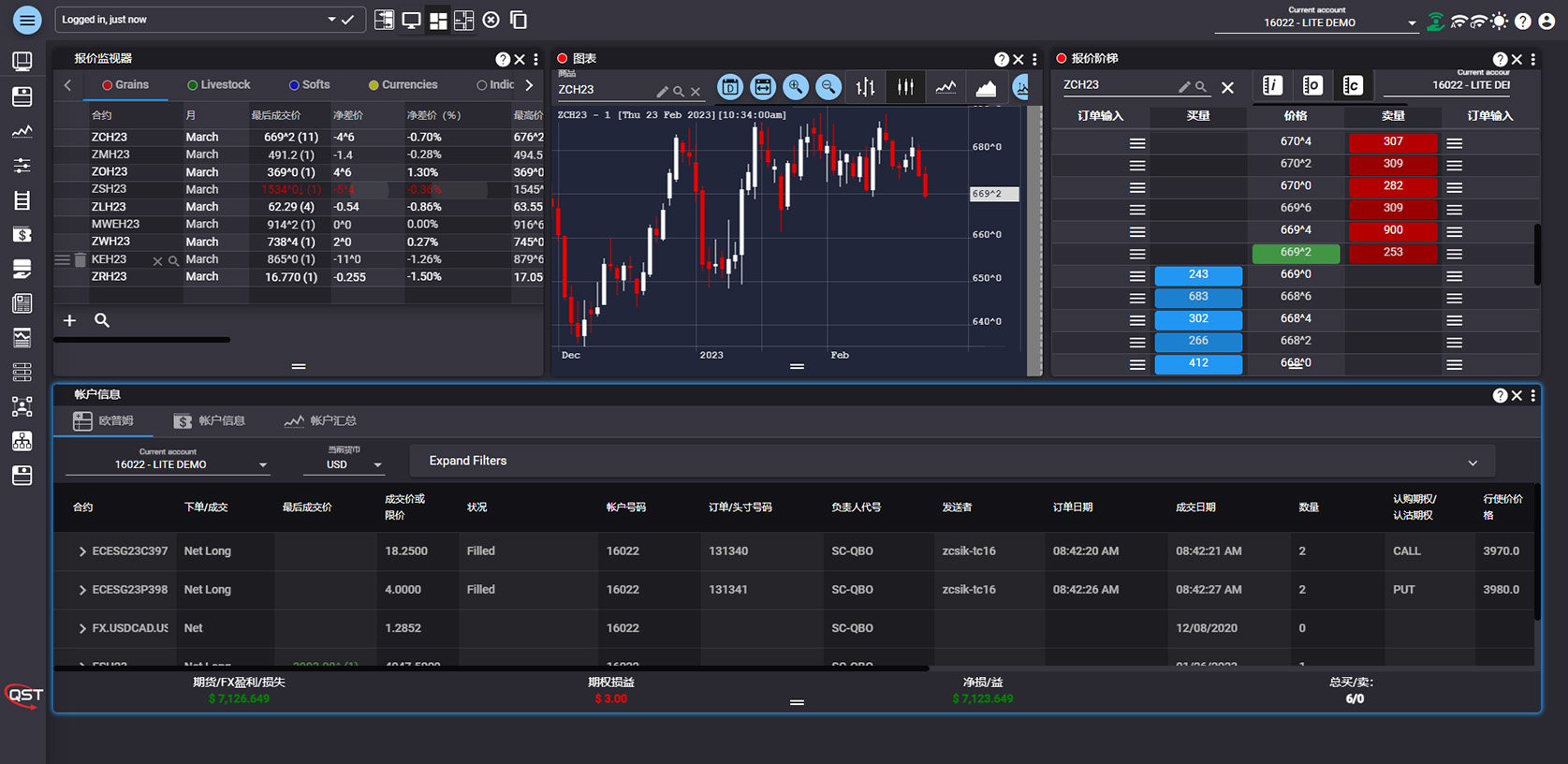

Quod Financial, a leading provider of adaptive trading technology, announced the launch of Unity, its proven integration architecture, now available as a standalone product. Unity delivers a new way for financial institutions to modernize their trading infrastructure, by unifying fragmented systems and workflows without the disruption of rip-and-replace projects.

Unity has long powered Quod Financial's modular trading suite, from OMS, EMS, SOR, algo trading, market making to TCA solutions. For the first time, financial institutions can now deploy Unity independently as the foundational layer for their architecture, with the choice to integrate Quod Apps or third-party systems.

The Challenge: Fragmentation and Costly Upgrades

Across the buy side, sell side, and wealth management industries, trading environments are often built on decades of siloed platforms and point integrations. OMS, EMS, AI tools, custodians, and post-trade systems rarely communicate seamlessly. Integration projects can take 12–24 months and cost millions, while vendor lock-in limits innovation and adaptability.

Fintech Business Asia, a business of FinTech Business Review

© 2025 FinTech Business Review. All Rights Reserved.