06 March 2025 | Thursday | News

Deploys capital towards opportunities in AI, quantum computing, digital assets, defence, biotechnology and more

Fayafi Investment Holding, the first UAE firm made available through a bankable certificate issued under the SIX Swiss Exchange framework, listed on the Vienna Stock Exchange and featured on Bloomberg, has announced a strategic expansion of its investment portfolio to capture emerging opportunities.

Fayafi has deployed USD 1.2 billion in investments towards diversified and high-growth opportunities in strategic industries. The move aligns Fayafi's long-term investment strategy with key financial, technological, and green finance opportunities.

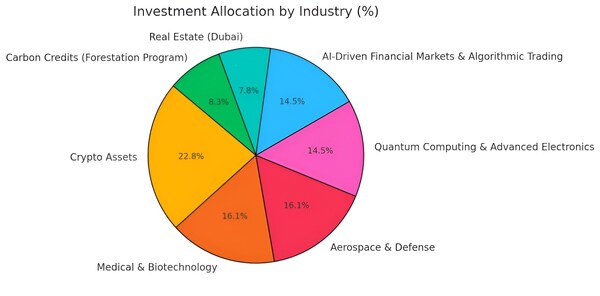

22% of the portfolio is geared towards digital assets, including Web3, tokenized finance and blockchain-based assets.

15.5% of the portfolio is allocated to medical and biotechnology, in line with Fayafi Investment Holding's mission of advancing human well-being and scientific innovation. The investments will power next-generation advances in genomics, AI-driven healthcare, and pharmaceuticals.

Aerospace and Defence allocations constitute another 15.5%, funding satellite technologies, defence AI, and next-generation aerospace materials as the firm looks to capitalize on increased long-term defence spending globally.

Quantum Computing & Advanced Electronics has a 14% allocation, with investments targeted towards AI hardware, and cryptographic quantum technology.

AI-Driven Financial Markets & Algorithmic Trading account for another 14%, with investments aimed at enhancing market prediction models, automated trading, and AI-powered hedge funds, to strengthen financial market efficiency.

7.5% is given over to real estate with a Dubai focus. Fayafi will strengthen its commercial and luxury real estate investments in Dubai, capitalizing on a stable and appreciating market.

8% is set aside for carbon credits and forestation programs, aligning with Fayafi Investment Holding's mission of creating a sustainable and secure future for humankind. The investment will create carbon offsets and monetized environmental impact investments that benefit local communities through job creation and upskilling

"At Fayafi, we recognize both the evolving financial landscape and the growing importance of sustainability in investment. Our investment expansion integrates advanced financial technologies with environmental responsibility, ensuring both profitability and long-term value creation for our stakeholders. We seek to take advantage of exciting global trends while positioning ourselves as a driving force for innovation across finance, technology, science and sustainability," said Dr.Patrick Pilati, Executive President, Fayafi Investment Holding Limited

In the short term, Fayafi Investment Holding is seeking increased market positioning, with liquidity generated through digital assets and AI-driven investments. In the longer term, Fayafi is banking on exponential growth in AI, quantum computing and biotechnology.

All investments are fully insured, ensuring capital security, risk mitigation, and compliance with regulatory frameworks. Compliance includes custodial insurance for digital assets; regulatory and R&D liability insurance for biotech, quantum and AI industries; property insurance and infrastructure risk protection for Dubai real estate; and carbon credit investment protection against environmental and land risks.

Meanwhile, a proprietary algorithm developed by Dr.Pilati, who is a behavioural finance specialist, in collaboration with Swiss mathematicians mitigates risk while capitalizing on market volatility.

Dr.Pilati will go live in Dubai to present SPV Fayafi Investment Fund's strategy to media representatives, stakeholders, and institutional investors. The date for this exclusive event will be announced on March 15th, 2025.

Fayafi Investment Holding Limited is a global leader in strategic commodity investments, with a presence on the SIX Swiss Exchange and Vienna Stock Exchange. The company specializes in advanced financial markets, digital assets, and sustainable investments, shaping the future of global finance through innovation and ESG-driven strategies. The firm is currently the highest-value UAE publicly listed company on foreign stock exchanges. It also ranks #4 GCC-wide, reinforcing Dubai and the UAE's credibility as a global financial hub.

Fintech Business Asia, a business of FinTech Business Review

© 2025 FinTech Business Review. All Rights Reserved.